Data Centers 2023: the Hybrid Option

Growth is set to continue

According to a recent report from Technavio*, the global data center market size is estimated to grow by US$ 615.96 billion (CHF 580,45 billion) from 2021 to 2026 with a CAGR of 21.98%. Quadintel* predicts a value of US$ 6.0 billion by 2028 with a significant CAGR of 4.5%. According to Research and Markets*, the global DC market is forecast to grow by 73% over the next four years.

This growth is based on several familiar factors, such as a rise in streaming, remote work and learning, analytics, IoT, Machine Learning, AI, and the digitization of industrial and business processes. What’s more, a growing number of small and medium-sized enterprises are increasingly adopting digital technology. Data Center as a Service (DCaaS) is widely seen as the next step from Infrastructure as a Service (IaaS).

Infrastructure for speed

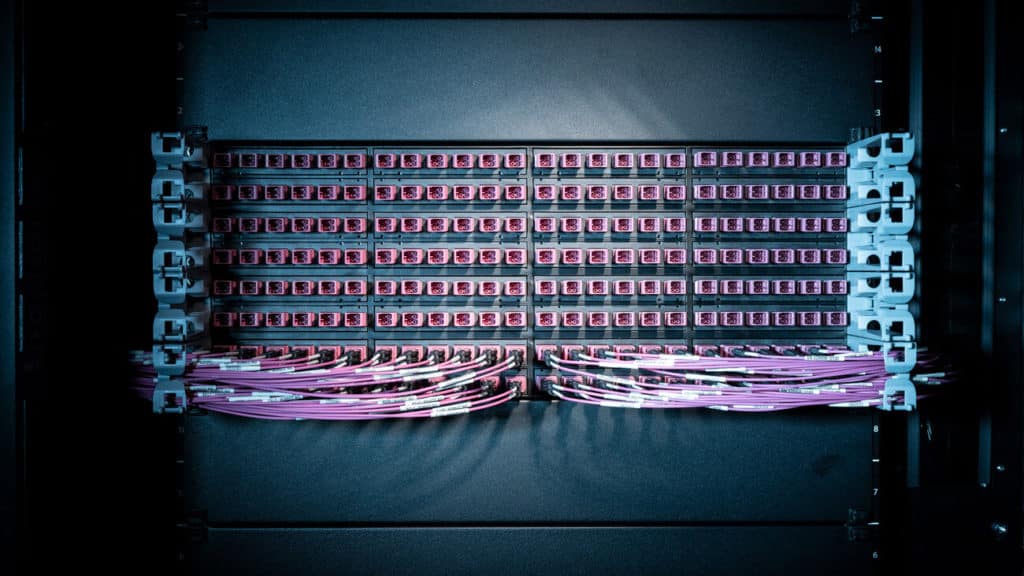

To meet today’s vast bandwidth demand, 100G and 400G might become standard sooner than we think. As the move to 400G and 800G continues, DCs are evaluating infrastructure and determining its future readiness. 40G and 100G required eight fibers in parallel pairs, but higher speeds require 16 or 32 pairs, which further boosts cable density.

Data center architectures are rapidly moving toward spine-leaf and fiber-dense mesh networks as well as EoR/MoR and ToR solutions that help simplify data center networks and deliver higher capacity. Smart migration paths, high-density-friendly products, preconfigured solutions, and monitoring and asset management will be needed to support 400G/800G.

As racks become increasingly densely packed, cables become more difficult to manipulate because it is harder to see what you’re doing. This is boosting the need for solutions that significantly reduce handling and installation time and guarantee functionality, such as pre-term cabling and new push-pull fiber connector types. Preconfigured cabinets fitted with power, cooling, security, and connectivity that allow infrastructure elements to communicate offer a neat solution for modular DC approaches.

Data centers are joining the convergence trend. Businesses are combining virtual, on-premises, and cloud infrastructures to form hybrid data centers.

The convergence trend

Data Centers are joining the convergence trend. Countless applications require real-time data processing on-site or close to where the action is in order to realize the required speed and reliability. Hybrid data centers can provide this by offering a combination of virtual, physical (on-premises), and cloud infrastructure. This approach introduces vast scalability and flexibility.

Depending on their needs, businesses can use edge DCs combined with main and local data centers. On-premises physical servers are converging into virtual network-based data centers, supported by multi-cloud computing developments. Latency-related drivers such as 5G and IoT will push further growth in this area.

Furthermore, digitalization is driving the ongoing convergence of IT and operational technology. Edge DCs often end up in areas where fewer trained support staff are available. Furthermore, smaller DCs might not have dedicated managers for facilities, IT, or infrastructure. Automated workflow can guide technical staff through processes and make MACs easier.

Fiber is the backbone

Unlike copper, fiber allows DC operators to migrate to higher speeds relatively quickly and easily. Local networks can establish long-distance connections via a fiber backbone providing fast, high-capacity connectivity between DCs, edge DCs, and end users.

Some DCs are even developing their own point-to-point optical networks to realize cost savings while accommodating bandwidth growth and increasing flexibility. More enterprise micro DCs are being linked via fiber-based access and backbone networks.

With products of the R&M Netscale family, the packing density of fiber optic connectors can be optimized in several ways.

Accurate insight is a must

As data centers continue to become more complex, provide more functions, and demand greater flexibility, up-to-date, accurate knowledge of the available infrastructure is a must. The ability to demonstrate the lifecycle of DC assets, such as switches or servers, for compliance purposes is also essential.

Operators want to know how fast new services or functionalities can be switched on, and that these will work as intended right from the start. Installation managers also need to be absolutely sure each port is connected exactly how they think it is to prevent security issues.

Impact of power consumption

Data centers have become far more energy-efficient, but the growing use of DCs means that they still consume vast amounts of power. The market for DC power is being driven by the growing popularity of cloud computing.

According to Cisco*, cloud DC IP traffic will hit 19,509 exabytes per year by 2023. For traditional data center traffic, this is expected to be 1,046 exabytes per year. The global data center power market size was valued at US$ 11.2 billion in 2021 and is projected to reach US$ 24 billion by 2031, according to Allied Market Research.

The power consumption of network equipment is being closely monitored. The impact of data center builds or expansions on local power grids may also become a key factor in planning approvals. As more private equity and government funding is being raised, the demand for demonstrably environmentally friendly and energy-efficient solutions is paramount.

Worldwide, organizations are working on reducing or eliminating their CO2 emissions with more energy-efficient infrastructure and best practices. This requires ongoing measurement of energy usage and factors such as temperature.

A key driver for DCIM is the need for information required to forecast capacity requirements.

DCIM provides data protection

Furthermore, besides traditional drivers, such as shortening mean-time-to-repair, predictive maintenance, energy efficiency, and optimizing utilization, data protection is now also an important consideration for DCIM. By 2025, global data generation should exceed 180 zettabytes – an annual growth of 40%. This increases vulnerability to security breaches, making monitoring of physical infrastructure and ports essential.

According to Future Market Insights*, the global DCIM market will reach US$ 13.5 billion by 2032, which would represent an increase of US$ 2.8 billion from 2021. Global DCIM market revenue is estimated to hit US$ 10 billion by the end of 2031, states Research Nester*.

As more functionality is moved to the cloud, we’re also seeing more cloud-based DCIM systems appearing. A key driver for DCIM is the need for information required to forecast capacity requirements.

*Sources: Technavio, Quadintel, Research and Markets, Cisco, Future Market Insights, Research Nester